Blog > How The Fed's Decision Affects Home Buyers and Sellers: LA Update

The Federal Reserve has just decided to keep interest rates unchanged for the fifth straight meeting, holding its benchmark rate in the range of 4.25% to 4.50%. So, what does this mean if you’re looking to buy or sell a home?

For home buyers, mortgage rates remain stubbornly high—hovering around 6.5% to 6.8% for a typical 30-year fixed loan. Because the Fed didn’t lower rates, there’s little immediate relief in sight for affordability. This keeps monthly payments expensive, making it tough for many buyers to enter the market. Still, buyers might benefit from a larger selection of homes, since higher rates have led to more listings and homes staying on the market a bit longer. Sellers are often forced to offer price cuts and other concessions to attract offers.

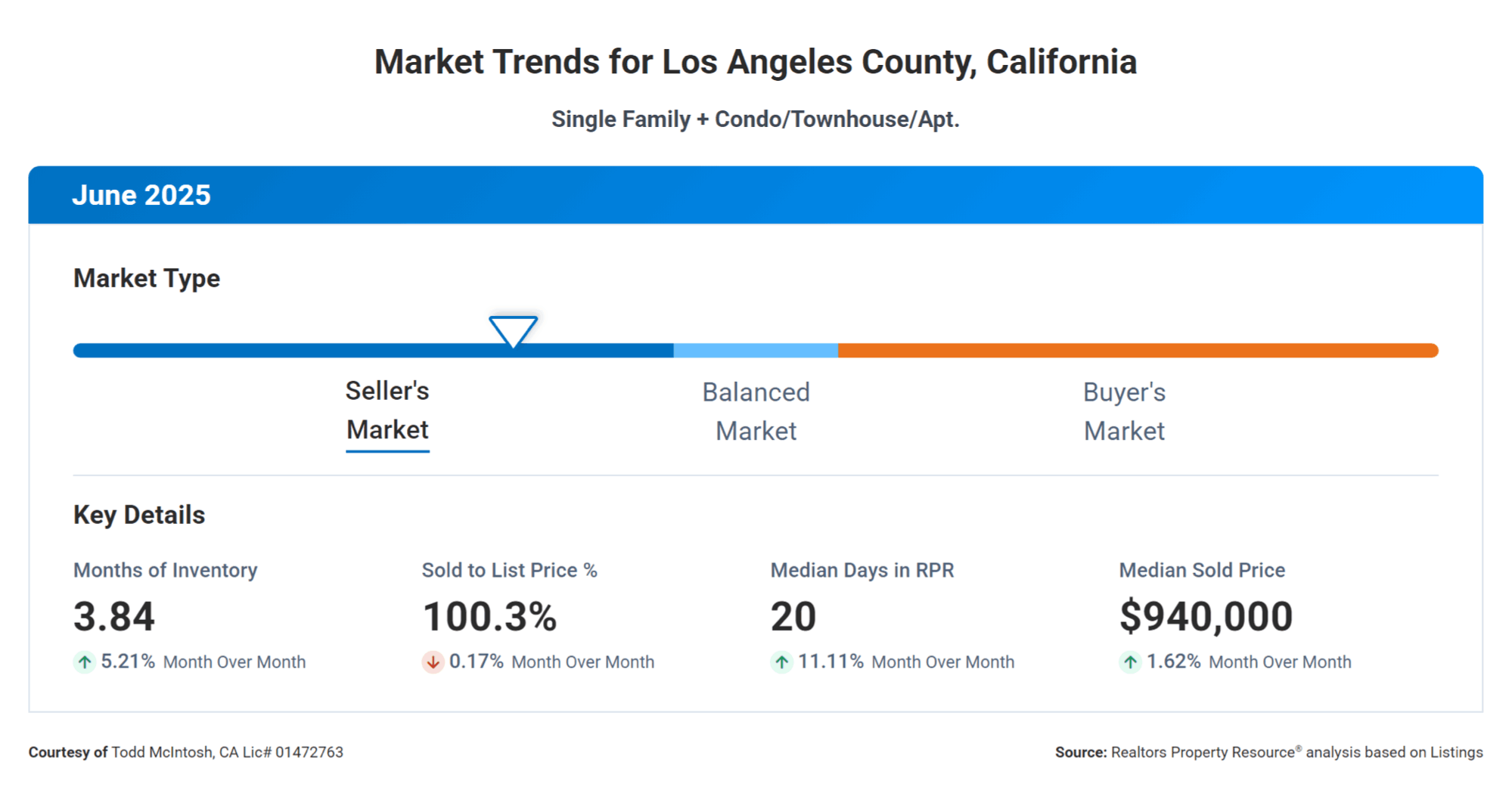

For sellers, the environment is challenging. Even though prices remain high, demand has softened, and the median home price just hit a record—over $435,000 ($940,000 here in Los Angeles). Homes are taking longer to sell, inventory is building, and more sellers are cutting prices to compete. If you’re hoping for a quick sale, be prepared to negotiate and perhaps accept less than your original asking price.

Bottom line? The Fed’s decision means the housing market stays stuck: buyers face tough affordability and sellers face stiffer competition. Both sides should prepare for a drawn-out market until there’s a clear shift in interest rates or economic conditions.